Introduction

So you’re aware of Marketing Mix Modeling and know that it can help push brands forward. But comprehending what MMM actually is and precisely how it benefits marketers has felt a little overwhelming.

Like many others, you may also believe that MMM can only be used to measure performance and not brand marketing. However, that’s actually not the case, and there’s a closer relationship between brand and performance marketing than you may realize.

With all that said, we understand the confusion, and to help better inform you on these topics, Forvio has a brief rundown of MMM’s potential impact on brand measurement over the long term right here:

Understanding Marketing Mix Modeling in Brand Measurement:

In simple terms, MMM is a collection of data sets that measures the impact of a brand’s various advertising efforts across a number of channels. It also includes additional variables, such as broad economic conditions or even changing weather, that may have an effect on marketing.

Brand measurement, the rate of consumer recognition and awareness of a brand, its name, logo, products, growth and other related data, is often integrated into an MMM build. Brand lists, consumer sentiment surveys and other studies may provide information for a model.

MMM, therefore, allows marketers to paint a more realistic picture of what’s working for a brand because the measurements are far more holistic. Letting all this data mingle — or mix! — together allows marketers to break down the impact of all the individual variables included in the model. If they choose, they may also identify how relatively impactful brand measurement itself may be on marketing efforts.

But brand measurement data can also emerge from out of an MMM study, via reverse engineering. If brand measurement is not included in a model, then an enterprising analyst can deduce its impact based on the presumption that it is affecting targeted consumers to some degree.

Statistical Approaches to Measure Brand Equity

It’s important to understand the level of equity — or a universally-held perception — a brand may have among consumers because people buy products from companies they recognize and trust the most. Measuring brand equity effectively includes both quantitative and qualitative data sets.

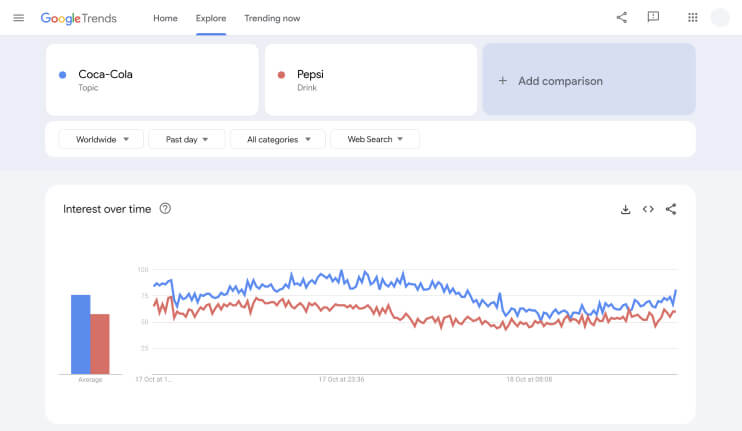

Quantitative data may include website clicks and conversions, social media reach and engagement, and of course sales of products, particularly at different price points, in different regions and during different campaigns, for example. There’s also simple Google Trends, which can be a key indicator of consumer interest over a given period of time. Brand managers can even see how their company stacks up against the competition. Say you work for Pepsi and you want to see how your brand awareness is faring against rival Coca Cola. The data derived from a simple Google Trends term search like this one below can easily be integrated into an MMM model and, when presented against other data sets — like the launching of specific campaigns, for example — help explain the peaks and valleys of consumer interest.

Qualitative data, which measures a memory or a feeling that a consumer may have when engaged with a brand, is extremely challenging to procure. The best researchers have done to date is through randomized surveys, with great deliberation over how to construct its questions. There are any number of approaches to question crafting and settling on one is highly dependent upon the type of product a given company is selling. But generally the aim is to find out how much (or how little) a brand is sticking out in the minds of consumers. One example could be: “Have you seen an ad for life insurance this past week?” Planting a question like this in a survey on a social media platform where such ads have run to targeted groups has become a popular means of measuring brand equity.

The True Relationship Between Brand and Performance Marketing

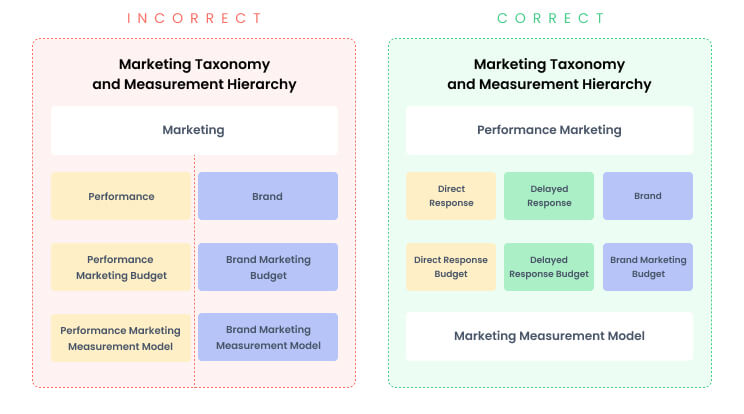

Performance and brand marketing should not necessarily be viewed as two separate endeavors. Yes, brand is different from, say, direct response marketing, to be sure, in part because direct response has very hard data connecting sales to ads, clearly measuring performance. However, brand is not the complete opposite of performance either.

As MDM wrote in a recent blog post, “Brand and performance marketing aren’t both taxonomy categories; performance marketing is a category, and brand marketing is a tactic that can sit within the performance marketing category.”

With that being the case, brand emerges as more measurable than initially thought.

The Evolution of Statistical Brand Measurement with MMM

With the advent of technological tools, such as AI, MMM is enjoying a resurgence in the marketing data analytics sphere. However, MMM’s history dates back several decades, back to a time when paper surveys, pens and maybe hole punchers were provided to a conference room. Quantifying all the consumer data from such efforts took months and by the time it was synthesized it ran the risk of being dated. Today, MMM operators collect large caches of data from a number of digital channels in real time and can develop insights, crucial to strategy development, within days. It intertwines more traditional billboard data and linear TV ad data with today’s smartphone clicks and Google search results-turned conversions, not to mention those digital consumer surveys that take seconds on social media platforms like YouTube — all in one place, creating a holistic bird’s-eye view of marketing impact, including your brand equity.

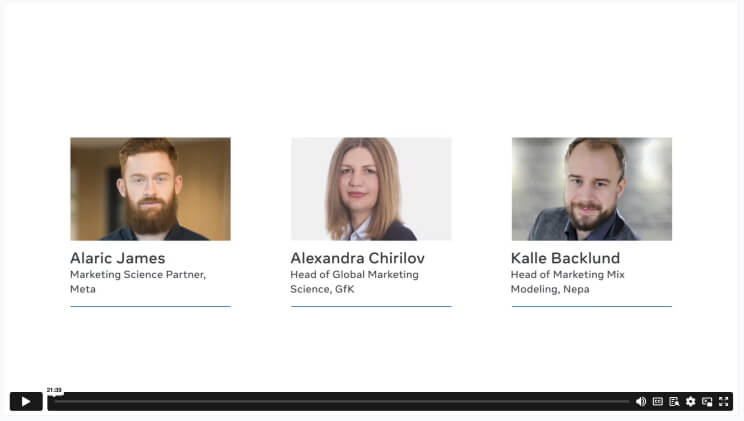

Those surveys can be crucial in measuring your brand’s equity, which in turn guides your team to build more effective brand marketing-style strategies and campaigns. Kalle Backlund, Head of MMM at the marketing insights firm Nepa, said during a Meta MMM summit that his team leverages “external” brand equity measurement, compiled through surveys, on a frequent basis and across extensive, continuous periods of time.

“Once you have that idea, put very simply, it’s a two-step process,” Backlund said. “One, understanding how the marketing drives brand, and step two, understanding how the brand in turn drives sales in the long term.”

Google and Meta/Facebook have also launched “Brand Lift” studies to help measure brand equity from ads on each of their platforms through survey tests. Resulting metrics may include the number of lifted users, cost per lifted user and baseline positive response rate, among others, on Google, as well as ad recall, brand awareness and message association, on Facebook.

Resulting campaigns from this level of data and insights become more impactful, establishing and nurturing relationships with consumers that then create purchasing behaviors they are less inclined to give up, helping your brand thrive through good times and bad.

Backlund also pointed out that “in some cases, share research and that kind of Google data could also serve as a sort of good proxy for brand strength, but the idea here is that we have a proxy that quantifies the evolvement of brand strength over time.” This observation was echoed in research by James Hankins, conducted when he was co-chair of the IPA Share of Search ThinkTank. He found that share of search can represent upward of 83% of a brand’s market share.

All this can be included in an MMM report.

“Forvio is using Google Search Console to measure organic search impressions as standard part of every model to represent the volume of how often a customer webpage appears in organic searches,” says Andy Kozak, co-founder and CPO of Forvio. “In one instance we were even able to find interesting patterns of customers searching for products online who actually ended up buying them offline.”

Case Study

What kind of benefits can come from MMM data and insights reports? Facebook, owned by Meta, launched an MMM open source library called “Robyn.” In one case study, an online home goods retailer that utilized the platform saw a 20% boost in revenue. After making budget alterations based on the Robyn report, the company increased its ad spend on Facebook and fine-tuned its approach to ads, which led to the revenue increase. All this occurred after just five days of MMM engagement.

Reference 1

Very good discussion on meta MMM summit GfK and Meta was figuring out ways of measuring brand lifts. Discussion was about the method that to measure long term brand effects is to use a third party survey that continuously measures brand equity / strength.

Source: https://mixmarketingmodelingsummitvir.splashthat.com/

Source: https://mixmarketingmodelingsummitvir.splashthat.com/Reference 2: James Hankins

We can also use Google search term volume as a decent proxy apparently, which is also echoed in the share of search work done by James Hankins.”

Reference 3: Andy Kozak - Forvio

Andy statement : Forvio is using Google Search Console measuring organic search impressions as standard part of every model to represent volume how often customer webpage appears in organic searches. We were able to find interesting patterns of customers searching for products online and ending buying them offline